Aggregate Positive Sentiment Index

Aggregate Positive Sentiment Index

Aggregate Positive Sentiment Index

Aggregate Positive Sentiment Index

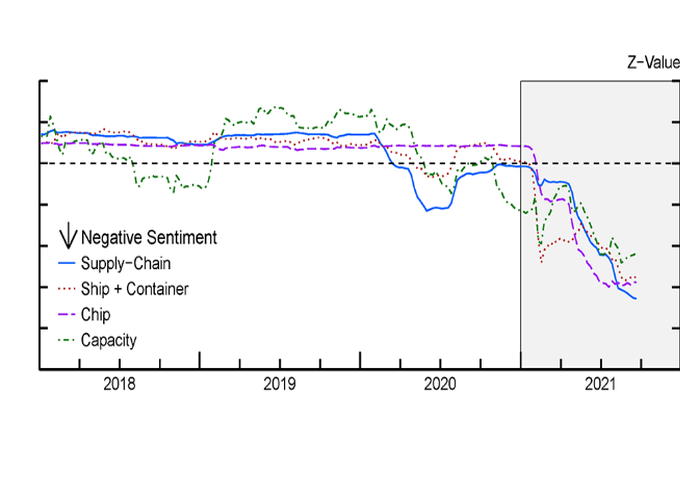

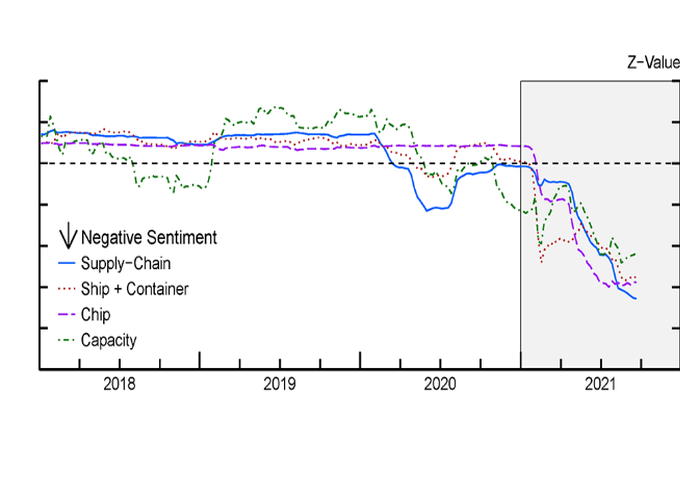

In this note, we first document to what extent companies are facing these supply bottlenecks and which sectors have been affected in a novel way. Specifically, we use textual analysis of earnings calls from the S&P Global Market Intelligence database, which includes 5,000-7,500 earnings calls from U.S. and foreign firms per quarter, to construct firm sentiment indexes about the bottlenecks. The benefit of this approach is that we have very timely data to synthesize information about what firms are seeing on the ground and what challenges they face. Additionally, we can differentiate firm sentiment across different industries. Second, we ask to what extent these supply bottlenecks have pushed up firms' prices as measured by the frequency of higher price references in their earnings calls. https://www.federalreserve.gov/econres/notes/feds-notes/effects-of-supply-chain-bottlenecks-on-prices-using-textual-analysis-20211203.htm